The financial system in the U.S. is designed to create opportunities for an individual to live better by

progressive enrichment. The growth of population and production of goods and services puts homeownership at the national level as an essential industry that must be protected and promoted. What happens in the housing industry has far reaching effects on other crucial areas of economic growth. The national policies of the housing industry have gone far to give a semblance of a social cause. When social wealth improves, the individual homeowner is the main beneficiary.

START WITH YOUR HOUSEHOLD BUDGET FOR HOMEOWNERSHIP

It is best to draw up a spreadsheet for yourself to figure out what discretionary income you have AFTER subtracting expenses from your regular steady income.

Typical expense categories are:

- Home Related Expenses

- Basic Expenses

- Cars/Transportation

- Utilities

- Telephones

- Food

- Education

- Medical

- Loans

- Recreation & Social Life

- Personal Maintenance

- Children

- Aging Parents

- Risk Management

- Other

Typically, most first-time home buyers are first-time family makers. Remember to set aside a reasonable budget for the start and care of your family.

EXPERT TIP: BUY YOUR HOME WITH A SMALL DOWN PAYMENT USING A LARGE LOAN

Your income capacity, saving and spending habits will qualify you for a loan to borrow money to purchase a home. You must discuss your loan capacity with a lender, bank or mortgage broker. When

you have a Letter of Loan Pre-Approval from a lender, you are in a position to shop for a home. Since the home buying process and procedures are complicated, always engage a REALTOR® to formally assist you. Typically, the seller pays the fee to the REALTOR® for services in selling the listed home.

EXPERT TIP: VALUE OF THE DECISION YOU ARE MAKING TO BUY A HOME

When a bank qualifies you for a home loan to make up for the shortfall from your down payment, the bank trusts you based on your savings, your current earnings, your spending habits; and believes in your commitment to honor the loan by your future earning power. This is your creditworthiness. This is the

power of leverage, an advantage by a small down payment for big borrowing. The bank keeps your property as collateral to recover loaned money if you fail in your commitment to pay.

You are making an astute financial decision to borrow money and use it in your homeownership process over time.

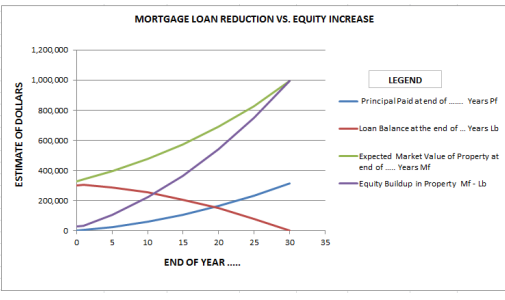

The graph above shows the typical life of a loan and progressive equity building up in your home. Note how you are building up your wealth by paying off the amortized loan at committed interest rate, and adding equity in your home due to the decrease in your loan balance and increase of its market property value over time.

In a healthy market, the price increase of residential real estate is 2% to 3% above consumer price index,

the inflation rate in the economy.

The present value of your decision to purchase today is the present dollar value of the anticipated future

value of the property likely to happen.

In conclusion, get a home purchase loan with the least fixed interest rate, lowest down payment, and

pay it back over time; the sooner the better!

This is the recipe for building family wealth via your income stream.

OKAY, WE HAVE A LITTLE … BUT WHERE DO WE START?

Pre-Qualify Yourself for Home Loan!

Download this Excel spreadsheet ‘Household Budget’

No comment yet, add your voice below!