First Time Homebuyers

The financial system in the U.S. is designed to create opportunities for an individual to live better by progressive enrichment. The growth of population and production of goods and services puts homeownership at the national level as an essential industry that must be protected and promoted. What happens in the housing industry has far reaching effects on other crucial areas of economic growth. The national policies of the housing industry have gone far to give a semblance of a social cause. When social wealth improves, the individual homeowner is the main beneficiary.

START WITH YOUR HOUSEHOLD BUDGET FOR HOMEOWNERSHIP

It is best to draw up a spreadsheet for yourself to figure out what discretionary income you have AFTER subtracting expenses from your regular steady income.

Typical expense categories are:

- Home Related Expenses

- Basic Expenses

- Cars/Transportation

- Utilities

- Telephones

- Food

- Education

- Medical

- Loans

- Recreation & Social Life

- Personal Maintenance

- Children

- Aging Parents

- Risk Management

- Other

Typically, most first-time home buyers are first-time family makers. Remember to set aside a reasonable budget for the start and care of your family.

EXPERT TIP: BUY YOUR HOME WITH A SMALL DOWN PAYMENT USING A LARGE LOAN

Your income capacity, saving and spending habits will qualify you for a loan to borrow money to purchase a home. You must discuss your loan capacity with a lender, bank or mortgage broker. When you have a Letter of Loan Pre-Approval from a lender, you are in a position to shop for a home. Since the home buying process and procedures are complicated, always engage a REALTOR® to formally assist you. Typically, the seller pays the fee to the REALTOR® for services in selling the listed home.

EXPERT TIP: VALUE OF THE DECISION YOU ARE MAKING TO BUY A HOME

When a bank qualifies you for a home loan to make up for the shortfall from your down payment, the bank trusts you based on your savings, your current earnings, your spending habits; and believes in your commitment to honor the loan by your future earning power. This is your creditworthiness. This is the power of leverage, an advantage by a small down payment for big borrowing. The bank keeps your property as collateral to recover loaned money if you fail in your commitment to pay.

You are making an astute financial decision to borrow money and use it in your homeownership process over time.

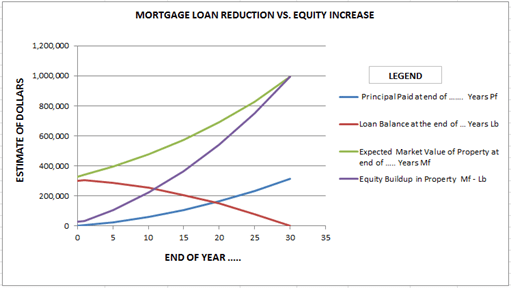

The graph above shows the typical life of a loan and progressive equity building up in your home. Note how you are building up your wealth by paying off the amortized loan at committed interest rate, and adding equity in your home due to the decrease in your loan balance and increase of its market property value over time.

In a healthy market, the price increase of residential real estate is 2% to 3% above consumer price index, the inflation rate in the economy.

The present value of your decision to purchase today is the present dollar value of the anticipated future value of the property likely to happen.

In conclusion, get a home purchase loan with the least fixed interest rate, lowest down payment, and pay it back over time; the sooner the better!

This is the recipe for building family wealth via your income stream.

OKAY, WE HAVE A LITTLE … BUT WHERE DO WE START?

Pre-Qualify Yourself for Home Loan!

Download this Excel spreadsheet ‘Household Budget’ template and work on it to pre-qualify yourself for a home mortgage load. This will save you a ton of headaches and aggravation.

For Home Sellers in Orlando Area

There are 5 types of home sellers. Which one are you?- Type 1: You have lived in your home for a number of years, and you want to sell to buy a new home.

- Type 2: You are an investor who purchased a rental property, and it is a great time to sell.

- Type 3: You are relocating due to a job-change or personal reasons, and you have to sell.

- Type 4: You have defaulted on a bank loan, and the bank is compelling you to sell the property to settle your debt.

- Type 5: You are a property flipper, who bought rundown property for a great price; after investing in renovation and reconstruction you created equity in the property and now want to sell to cash in on the equity.

For Residential Property Investors in Orlando, FL

Real Estate investors come in a wide variety of personas. They have different goals and different financial restrictions to work with. Typically, an investor falls in one of these flavors:- Buy bank owned properties for dimes on a dollar. Fix, sell and make money.

- Buy distressed properties on Courthouse steps. Fix, sell, and make money.

- Buy properties in high-risk settings for rental with intensive property management.

- Buy properties in low-risk settings for long-term rental with soft property management.

- Buy properties with personalities for rental, and leave professional property managers to manage.

- Buy properties as REIT (real estate investment trust) in corporate settings, for long-term rental and value appreciation.

- Sell rental properties the investor has been holding on to, to pull equity.

- Sell rental properties when seller is changing over to other investment strategies.

- Buy residential zoned lot from developer or in open market, build home and sell.

- Buy run down property in upcoming area, demolish and build new home to sell.

- Foreign buyers and sellers of properties who want to take advantage of current market conditions.

- Have plenty of life left before obsolescence.

- Are in areas that are up-and-coming, buzzing with life.

- Are in great demand by dependable renters in middle class income, who may be potential buyers in the near future.

Thinking of relocating south for the Winter? Buying a second home in a beautiful, warmer climate with lots of sunshine?

Orlando is the Florida destination for you!

Migratory birds have an uncanny instinct when to leave the brutal cold of the north and move down to the warm south. These birds have an amazing internal navigation system, internal GPS. They know when to fly out, where to rest, where to reach, how long to stay, when and where to breed

and return.

Taking a cue from migratory birds, people from colder climates of North America and Canada, who have the choice and financial resources to live away from their home city, tend to relocate to warmer places with longer days and daylight hours.

For seniors, blizzards and bone-chilling temperatures do not bring excitement, rather they bring anxiety and fear.

Florida is a favorite for permanent relocation and for second home nests. Orlando is one of the best and most popular choices for relocation for those with the means and financial resources.

Central Florida in general is high on the popularity scale for relocation.

Orlando ranks as MOST popular.

Browse over this article in Wikipedia and compare its attractions with other places you may like to relocate to. About 70 million people visit this international city every year. Traffic runs smooth. Civic sense is high. Public services are superb.

Relocation is a big decision to make.

To make it easier we have provided some resources for you to browse over about the Orlando Metropolitan Area (Orange County, and surrounding areas). It is extremely important that you select the community where you’d like to buy your new home and get to know the values of the properties there. Apply SEARCH criteria on this site to pull up properties, and you will narrow down your choice pretty soon. Register on the website in the Footer to save your SEARCHES and see TRENDS in specific area where your interest develops.

It is always great idea to visit Orlando, spend a few days and familiarize yourself with the area.

It will be more than worth your trip to engage an experienced Realtor to discuss your plans, options, and to get to know the local information for purchase of your new home.

Feel free to contact me for specific information.