The paperwork process and key steps you must take for profitable investments

Who is Considered a Foreign Investor in the U.S.?

USA is the only country in the world that welcomes anyone to buy real properties in the US without being a resident of the US. The only requirement is that a foreign investor pays taxes related to real estate income. A foreign investor can even acquire a property remotely by following certain procedures.

For purpose of taxation on the foreign investments in the US, the Internal Revenue Service (IRS) defines a foreigner respectfully as ‘non-resident alien’ (NRA). Click here to see the definition and explanation of

“Foreign Persons”.

Why Invest in Real Properties in the U.S.?

Growth of wealth is closely associated with assets a person owns and the cash holding the assets commands. It is always challenging for capital cash holder as to where and how to invest their cash; that it either makes active ongoing regular cash, a passive promised increase in cash, or generates steady cash, while either holding or increasing its value over time. Any mode of investment has built-in risk involved. When the risk factor is high, the investor may lose cash and peace of mind. When the risk is low the investor maintains patience to keep close control on their investment.

Investing in real estate – residential or commercial – has always attracted foreign investors who expect fair returns and holding value of properties. Such expectations of investors are a fusion of art, science and market forces that prevail.

The popularity of Foreign Investments in Florida

According to the National Association of Realtors, for the period of April 2021 through March 2022, highlights of the international buyers of residential real estate are as follows:

- Foreign buyers purchased $59 billion worth of U.S. existing homes, an 8.5% increase over the previous 12 months. Florida led the nation with 24% buyers, followed by California 11%, Texas 8%, Arizona 7%, New York 4%, and North Carolina 4%.

- Amongst international buyers, the average value of the property was $598k, and the median value as $366k.

- China and Canada remained first and second in U.S. residential sales dollar volume at $6.1 billion and $5.5 billion respectively, followed by India $3.6 billion, Mexico 2.9 billon, and Brazil $1.6 billion.

- 44% of foreign buyers purchased their property for use as a vacation home, rental property, or both.

- 64% purchased detached single-family homes and town homes

The popular destinations for foreign buyers in Florida have been Miami and Orlando metropolitan areas. Orlando is the premier destination for tourists. Orlando hosts 70 million visitors every year. If you belong to a very cold country, we urge you to visit Orlando during winter months (November to March) to experience what it is like here. We are here to help you turn your dream goals into reality and acquire income-producing properties.

How to Get Started

- Having decided where to invest in real properties in the U.S., you can get started with important paperwork to establish your identity in the U.S.

- It is best to engage a Certified Professional Accountant (CPA) to help you in filing your paperwork. There are certified CPAs available in your country to help you with the filing of the appropriate paperwork to establish your U.S. identity to do business. At the minimum, you would need to take care of the following paperwork:

- ITIN: (Individual Tax Identification Number). This may be treated equivalent to a Social Security, the unique number for U.S. citizens and Resident Aliens (green card holders).

- To pay taxes to the Internal Revenue Service (IRS), you as a foreign person must have an individual tax identity as ITIN. You must file an application on IRS Form W-7.

- Browse over instructions on how and where to fill and file this important form.

- It is important that you find out the reference of the tax treaty between the US and your home country to get the advantage of the reduction of withholding of taxes.

Scope of Investment:

The IRS has two categories for taxes on your foreign income, which relate to the scope and extent of your investment interests of business activity identifiable as follows:

- FDAP: (Fixed or Determinable, Annual or Periodical income from U.S. source). This is the case when you are a passive investor in real estate for properties generating rental income.

- You pay a flat 30% withholding tax through your designated Withholding Agent, or lower rate if there is a treaty between the US and your home country.

- After obtaining your ITIN, you also must file an application on IRS Form W-8BEN. You must provide a copy of this approved application from the IRS to the ‘Withholding Agent’ (mentioned below) and your accountant for tax and disbursement purposes.

- If the US and your home country have a tax treaty, there may be a substantial reduction of withholding tax. Browse over instructions for this Form W-8BEN. Note that you are making this application in capacity as an ‘individual’.

- You file annual tax return on IRS Form 1042-S: Foreign Person’s U.S. Source Income Subject to Withholding. Browse over Instructions for Form 1042-S.

- ECI: (Effectively Connected Income) When you are actively engaged in trade or business of real properties through the management structure you have setup in the U.S. to run affairs of your

business and you oversee its operations, you have tax status of Effectively Connected Income. In this case, you pay taxes on your ‘effectively connected income’ (ECI) to the IRS (Internal Revenue Service) as if you are a U.S. citizen. - After obtaining ITIN, you also should file an application on IRS Form W- 8ECI for setting up your business. Give a copy of the approved application from IRS to ‘Withholding Agent’ (mentioned below) for tax withholding and disbursement purposes.

- If the US and your home country have a tax treaty, there is reduction of withholding tax. Browse over instruction for this Form W-8ECI. Note that you submit papers regarding your country of

incorporation or organization if you are not applying as an individual. Your accountant will prepare your annual tax return on IRS Form 1040NR: U.S. Nonresident Alien Income Tax Return, and IRS Form 1120-F U.S. Tax Return for Foreign Corporation. Browse Instructions for Form 1040NR, and Instruction for Form 1120-F. There is no withholding tax here. - You may have both FDAP and ECI income. In this case, you must file both IRS Form W-8BEN and IRS Form W-8ECI. You must file an annual tax return, preferably through your accountant, to pay taxes and claim refunds as if you are a US citizen. U.S. tax laws are complex, so leave it to your tax professional to do it for you.

Structure of Ownership

Even if you are a solo investor, it is important to cover yourself under the protection of a foreign legal entity or entities that create layers of ownership privacy and tax matters having perpetuity of legal life and management of business. It is best to consult a local tax counsel and a tax adviser to design a legal ownership and tax structure to protect you and your business and assets. Do not cut corners here! Written professional advice is indispensable.

Withholding Agent

Definition, duties and responsibilities are set out in Chapter 3 and Chapter 4 of the IRS Publication 515: Withholding of Tax on Nonresident Alien and Foreign Entities. This is either an entity or person, US or foreign designated, entrusted, and declared to the U.S. Internal Revenue Service who will control

receipts and disbursements on your behalf. The IRS treats a ‘Withholding Agent’ personally liable for any taxes required to be withheld and disbursed, including accuracy of statements on your behalf. It is extremely important that you designate your Withholding Agent and declare it to the IRS in your application to the IRS. The Withholding Agent is your representative holding your money and disbursing to the right owners. The Withholding Agent acts on your behalf for the life of the property until you sell

or transfer the property in its final disposition.

In as much as you need structure of ownership in the U.S., which is in perpetuity, you also need your Withholding Agent that has life in legal perpetuity besides its reputation and services to you acting on

your behalf.

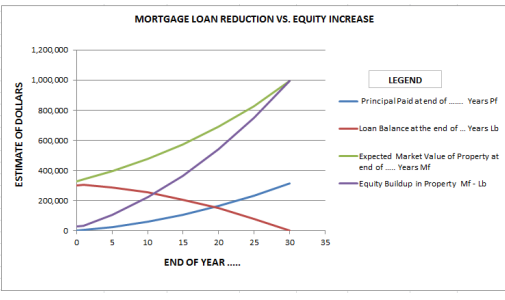

Availability of Loans

It is a good idea to place your money in the bank having its branch in your country, and get a loan from that bank. Loans are available on self-occupied vacation and investment properties based on your financial strength and creditworthiness. Typically, you may be able to get about sixty percent loans on

value of the property. If the same bank can provide a ‘Withholding Agent’, so much the better.

Property Management:

It is always advisable to engage the services of a licensed professional property management firm to take care of your property. Their duties will include dealing with potential tenants, renting out your property, attending to complaints from tenants, getting legal help when required, and arranging to have rents transmitted to your account and tax withholdings to your Withholding Agent. A property manager is your representative to the tenant of your property, and a firm should be carefully selected.

Start of Business

When you get an approved application(s) from the IRS on Form W-8ECI or Form W-8BEN, give copies to your accountant, your withholding agent, your property management company, and your real estate

professional. These papers are your business identity to do business in the U.S. The above parties comprise YOUR team and will help you in accomplishing your investment goals.

They will be instrumental in preparing your business model for acquisition of properties, finding investment properties and explaining rental income potential.

When you, the foreign owner of real property decides to dispose of your property, called disposition, you are liable to pay taxes to the IRS. The IRS controls collection of taxes for disposition of the U.S. property by Foreign Investment in Real Property Tax Act (FIRTPA) by withholding 15% of the amount realized on disposition of the property through Title/Settlement companies at the transaction closing. The Title/Settlement Company will transmit this withheld tax amount to the designated Withholding Agent who will sign off on Form 8288 and file this form along with withheld tax money transmitted to the IRS. Click here for instruction on filing Form 8288. The IRS will date stamp receipt of the signed Form 8288 by the Withholding Agent and acknowledge receipt of advance tax deposit to you. Your accountant will need a copy of this receipt when preparing your annual tax return.

The IRS must get its taxes upfront. They do not wait for a foreign owner to file a return and then pay taxes. The regulation even goes to the extent of holding the buyer of the property liable to pay taxes by filing Form 8288 (Part I), or having the Withholding Agent to sign off on Part II of the Form 8288 .

The Title/Settlement Company will file settlement papers with the IRS, and will ensure who pays withheld advance taxes to the IRS on Form 8288.

Visa Situation for Foreign Investors

If you plan to get a U.S. visa to live and do business in the U.S., you may try to get an appropriate visa for an extended stay in the U.S. and run the business. This should be discussed with an immigration attorney

How Can We Help You?

As real estate professionals we are your service partners in accomplishing your investment goals for residential properties in Orlando, Florida.

It is feasible to target potential rental properties that may give you a safe return of around seven percent Revenue-to-Price.

We work in a team environment of established professionals in Orlando metropolitan area with excellent reputations, track records, and significant expertise in all critical areas of investing, buying and selling.

If you are a foreign seller of your properties in Orlando, or close to Orlando, we are here to help you sell your property or properties with the help and assistance of your property manager and Withholding Agent.

Questions?

Drop us an email with your questions, and we will provide prompt, helpful responses. Let us help you work on your model for acquisition or sale.

We are here to help with your investment and ROI!